You need some help. May be time for an intervention.Bump for Raiders the liar, he said he never posted that Mahomes and Alex Smith are the same QB, so I had to prove him the liar he is

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Bitcoin crosses $50k

- Thread starter raiders72001

- Start date

3 months and BTC goes parabolic. WWIII is the only thing that can stop it.

Sportsrmylife

EOG Master

Elon is a master at knowing what stockholders want to hearif u got tesla stock better hope robots work with robo taxi

Stock up over 11% after market from the earnings call

Patrick McIrish

OCCams raZOR

We got a pretty good shot too if Donald and the Royal Family are back in office.

It'll be great for the crypto crowd as well.

It'll be great for the crypto crowd as well.

cheapseats

EOG Master

Roaring Kitty back today. Hummmm!

pro analyser

EOG Dedicated

Roaring Kitty back today. Hummmm!

Patrick McIrish

OCCams raZOR

Raiders, or anyone else with knowledge......

Binance is going to stop handling XRP, is that telling me what I think it's telling me.

Hasn't been long but so far price actually went up a little.

Binance is going to stop handling XRP, is that telling me what I think it's telling me.

Hasn't been long but so far price actually went up a little.

Patrick McIrish

OCCams raZOR

August and September are generally not great months to begin with, Mt Gox situation isn't helping.

I don't think it's going under 50K though and by end of year it's 100K or more.

In the short term Flip-flop around and a serious run begins late September or so.......

I don't think it's going under 50K though and by end of year it's 100K or more.

In the short term Flip-flop around and a serious run begins late September or so.......

cheapseats

EOG Master

Mt Gox certainly an issue with recent decline. FED comments, too. Market seems to be shading rate cut(s) by years end. Rate trend is biggest driver.

Sportsrmylife

EOG Master

Bitcoin going to hit 53k

Then skyrocket to new all time highs

80k+

Then skyrocket to new all time highs

80k+

Bitcoin ETFs Herald Less Febrile Token Longer Term, Traders Say

- Inflows into US funds helped to steady Bitcoin after a selloff

- Token’s volatility tops stocks, gold but the gap is narrowing

- Bitcoin started the week nursing a slump that stoked fears of outflows from dedicated US exchange-traded funds. Instead dip buyers poured in cash, a pattern that for some points to a less volatile token longer term.

A net $737.5 million was added to the 11 ETFs in the four days to Thursday, steadying Bitcoin near $58,000 after a drop to $53,602 on July 5 amid sales of seized tokens and fears of disposals by creditors of the failed Mt. Gox exchange.

Market participants argue the ETFs from titans including BlackRock Inc. and Fidelity Investments offer the type of bedrock demand that can temper price swings. The six-month-old portfolios have amassed about $51 billion in assets — more than 4% of Bitcoin supply — and feature hedge funds and wealth advisers as top holders. Such specialist institutions are a contrast to the individual investors lured to crypto in earlier years as a get-rich-quick trade.

Declining Trend

Gauges of Bitcoin swings have already trended lower in the past decade, though they remain higher than for assets such as stocks or gold. For example, the gap between 180-day measures of realized volatility for the token and the yellow metal has narrowed by over 100 percentage points during the period to 28 percentage points.

Last edited:

Patrick McIrish

OCCams raZOR

60k next week. but some downturns of course will happen next couple years.

Buybuybuy right on the money, 60K it is.

Patrick McIrish

OCCams raZOR

You are correct Top, he's slated to speak at the BitCoin 2024 get-together in Nashville later this month.

Assassination attempt? Who cares, the American hero and icon that is Donald Trump can not be swayed.

Assassination attempt? Who cares, the American hero and icon that is Donald Trump can not be swayed.

trytrytry

All I do is trytrytry

this this this60k next week. but some downturns of course will happen next couple years.

Vance is a crypto guy.

cheapseats

EOG Master

Broke 80 and now back 79.5....

cheapseats

EOG Master

Just left 81k in the rvm

Patrick McIrish

OCCams raZOR

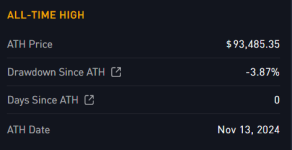

$89,995.12 at some point today, that's what you call tickling 90K.

My 100K end of year prediction right on target......

My 100K end of year prediction right on target......

trytrytry

All I do is trytrytry

Patrick McIrish

OCCams raZOR

Best thing about Trump is even those too stupid to vote for him will benefit.....

BTC over 97K and sure to keep climbing.

BTC over 97K and sure to keep climbing.

boston massacre

EOG Master

Best thing about Trump is even those too stupid to vote for him will benefit.....

BTC over 97K and sure to keep climbing.