You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Warren Buffet and.....

- Thread starter cassiusclay

- Start date

cassiusclay

EOG Master

Re: Warren Buffet and.....

he uses the kelly gambling system for his investments......

he uses the kelly gambling system for his investments......

cassiusclay

EOG Master

Re: Warren Buffet and.....

Kelly criterion

From Wikipedia, the free encyclopedia

Jump to: navigation, search

<!-- start content -->In probability theory, the Kelly criterion, or Kelly strategy or Kelly formula, or Kelly bet, is a formula used to determine the optimal size of a series of bets. In most gambling scenarios, and some investing scenarios under some simplifying assumptions, the Kelly strategy will do better than any essentially different strategy in the long run. It was described by J. L. Kelly, Jr, in a 1956 issue of the Bell System Technical Journal<SUP class=reference id=cite_ref-original_Kelly_article_0-0>[1]</SUP>. Edward O. Thorp demonstrated the practical use of the formula in a 1961 address to the American Mathematical Society<SUP class=reference id=cite_ref-Thorp_talk_1-0>[2]</SUP> and later in his books Beat the Dealer<SUP class=reference id=cite_ref-Beat_the_Dealer_2-0>[3]</SUP> (for gambling) and Beat the Market<SUP class=reference id=cite_ref-Beat_the_Market_3-0>[4]</SUP> (with Sheen Kassouf, for investing).

Although the Kelly strategy's promise of doing better than any other strategy seems compelling, some economists have argued strenuously against it, mainly because an individual's specific investing constraints override the desire for optimal growth rate.<SUP class=reference id=cite_ref-Poundstone_book_article_4-0>[5]</SUP> The conventional alternative is utility theory which says bets should be sized to maximize the expected utility of the outcome (to an individual with logarithmic utility, the Kelly bet maximizes utility, so there is no conflict). Even Kelly supporters usually argue for fractional Kelly (betting a fixed fraction of the amount recommended by Kelly) for a variety of practical reasons, such as wishing to reduce volatility, or protecting against non-deterministic errors in their advantage (edge) calculations.<SUP class=reference id=cite_ref-Wilmott_I_5-0>[6]</SUP>

In recent years, Kelly has become a part of mainstream investment theory<SUP class=reference id=cite_ref-Handbook_of_Asset_and_Liability_Management_6-0>[7]</SUP> and the claim has been made that well-known successful investors including Warren Buffett<SUP class=reference id=cite_ref-The_Dhandho_Investor_7-0>[8]</SUP> and Bill Gross<SUP class=reference id=cite_ref-Wilmott_II_8-0>[9]</SUP> use Kelly methods. William Poundstone wrote an extensive popular account of the history of Kelly betting in Fortune's Formula<SUP class=reference id=cite_ref-Poundstone_book_article_4-1>[5]</SUP>.

<TABLE class=toc id=toc summary=Contents><TBODY><TR><TD>Contents

[hide]

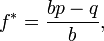

[edit] Statement

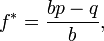

For simple bets with two outcomes, one involving losing the entire amount bet, and the other involving winning the bet amount multiplied by the payoff odds, the Kelly bet is:

<DL><DD> </DD></DL>where

</DD></DL>where

If the gambler has zero edge, i.e. if b = q/p, then the criterion will usually recommend the gambler bets nothing (although in more complex scenarios, where for instance a short priced favourite in a horse race may be worth covering to provide downside protection even though the only advantageous bet is on another outsider, will be correctly bet on to ensure the best compounding rate of return). If the edge is negative (b < q/p) the formula gives a negative result, indicating that the gambler should take the other side of the bet. For example, in standard American roulette, the bettor is offered an even money payoff (b = 1) on red, when there are 18 red numbers and 20 non-red numbers on the wheel (p = 18/38). The Kelly bet is -1/19, meaning the gambler should bet one-nineteenth of the bankroll that red will not come up. Unfortunately, the casino reserves this bet for itself, so a Kelly gambler will not bet.

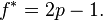

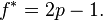

For even-money bets (i.e. when b = 1), the formula can be simplified to:

<DL><DD> </DD></DL>Since q = 1-p, this simplifies further to

</DD></DL>Since q = 1-p, this simplifies further to

<DL><DD> </DD></DL>

</DD></DL>

[edit] Proof

For a rigorous and general proof, see Kelly's original paper<SUP class=reference id=cite_ref-original_Kelly_article_0-1>[1]</SUP> or some of the other references listed below. Some corrections can be found in: Optimal Gambling Systems For Favourable Games:- L. Breiman, University of California, Los Angeles.

We give the following non-rigorous argument for the case b = 1 to show the general idea and provide some insights.

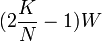

When b = 1, the Kelly bettor bets 2p - 1 times initial wealth, W, as shown above. If she wins, she has 2pW. If she loses, she has 2(1 - p)W. Suppose she makes N bets like this, and wins K of them. The order of the wins and losses doesn't matter, she will have:

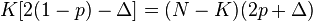

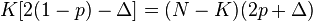

<DL><DD> </DD></DL>Suppose another bettor bets a different amount, (2p - 1 + Δ)W for some positive or negative Δ. He will have (2p + Δ)W after a win and [2(1 - p)- Δ]W after a loss. After the same wins and losses as the Kelly bettor, he will have:

</DD></DL>Suppose another bettor bets a different amount, (2p - 1 + Δ)W for some positive or negative Δ. He will have (2p + Δ)W after a win and [2(1 - p)- Δ]W after a loss. After the same wins and losses as the Kelly bettor, he will have:

<DL><DD> </DD></DL>Take the derivative of this with respect to Δ and get:

</DD></DL>Take the derivative of this with respect to Δ and get:

<DL><DD> </DD></DL>which equals zero if:

</DD></DL>which equals zero if:

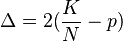

<DL><DD> </DD></DL>which implies:

</DD></DL>which implies:

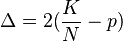

<DL><DD> </DD></DL>but:

</DD></DL>but:

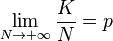

<DL><DD> </DD></DL>so in the long run, final wealth is maximized by setting Δ to zero, which means following Kelly strategy.

</DD></DL>so in the long run, final wealth is maximized by setting Δ to zero, which means following Kelly strategy.

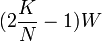

This illustrates that Kelly has both a deterministic and a stochastic component. If you knew K and N and had to pick a constant fraction of wealth to bet each time (otherwise you could cheat and, for example, bet zero after the K<SUP>th</SUP> win knowing that the rest of the bets will lose), you will end up with the most money if you bet:

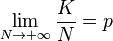

<DL><DD> </DD></DL>each time. This is true whether N is small or large. The "long run" part of Kelly is necessary because you don't know K in advance, just that as N gets large, K will approach pN. Someone who bets more than Kelly can do better if K > pN for a stretch, someone who bets less than Kelly can do better if K < pN for a stretch, but in the long run, Kelly always wins.

</DD></DL>each time. This is true whether N is small or large. The "long run" part of Kelly is necessary because you don't know K in advance, just that as N gets large, K will approach pN. Someone who bets more than Kelly can do better if K > pN for a stretch, someone who bets less than Kelly can do better if K < pN for a stretch, but in the long run, Kelly always wins.

[edit] Reasons to bet less than Kelly

A natural assumption is that taking more risk increases the probability of both very good and very bad outcomes. One of the most important ideas in Kelly is that betting more than the Kelly amount decreases the probability of very good results, while still increasing the probability of very bad results. Since in reality we seldom know the precise probabilities and payoffs, and since overbetting is worse than underbetting, it makes sense to err on the side of caution and bet less than the Kelly amount.

Kelly assumes sequential bets that are independent (later work generalizes to bets that have sufficient independence). That may be a good model for some gambling games, but generally does not apply in investing and other forms of risk-taking. Suppose an investor is offered 10 different bets with 40% chance of winning and 2 to 1 payoffs (this is the example used above). Considering the bets one at a time, Kelly says to bet 10% of wealth on each, which means the investor's entire wealth is at risk. That risks ruin, especially if the payoffs of the bets are correlated.

The Kelly property appears "in the long run" (that is, it is an asymptotic property). To a person, it matters whether the property emerges over a small number or a large number of bets. It makes sense to consider not just the long run, but where losing a bet might leave you in the short and medium term as well. A related point is that Kelly assumes the only important thing is long-term wealth. Most people also care about about the path to get there. Two people dying with the same amount of money need not have had equally happy lives. Kelly betting leads to highly volatile short-term outcomes which many people find unpleasant, even if they believe they will do well in the end.

One of the most unrealistic assumptions in the Kelly derivation is that wealth is both the goal and the limit to what you can bet. Most people cannot bet their entire wealth, for example it is illegal to bet your future human capital (you cannot sell yourself into slavery). On the other hand, people can bet money they do not have by borrowing. A person who is allowed to bet more than his wealth might choose to bet more than Kelly (if you know you can always borrow a new stake, it makes sense to take more risk) while someone who is constrained to bet much less than his wealth (say a young college graduate with high lifetime potential earnings but no cash or credit) is forced to bet less.

[edit] Bernoulli

In a 1738 article, Daniel Bernoulli suggested that when you have a choice of bets or investments you should choose that with the highest geometric mean of outcomes. This is mathematically equivalent to the Kelly criterion, although the motivation is entirely different (Bernoulli wanted to resolve the St. Petersburg paradox). The Bernoulli article was not translated into English<SUP class=reference id=cite_ref-Bernoulli_translation_9-0>[10]</SUP> until 1956 but the work was well-known among mathematicians and economists.

Kelly criterion

From Wikipedia, the free encyclopedia

Jump to: navigation, search

<!-- start content -->In probability theory, the Kelly criterion, or Kelly strategy or Kelly formula, or Kelly bet, is a formula used to determine the optimal size of a series of bets. In most gambling scenarios, and some investing scenarios under some simplifying assumptions, the Kelly strategy will do better than any essentially different strategy in the long run. It was described by J. L. Kelly, Jr, in a 1956 issue of the Bell System Technical Journal<SUP class=reference id=cite_ref-original_Kelly_article_0-0>[1]</SUP>. Edward O. Thorp demonstrated the practical use of the formula in a 1961 address to the American Mathematical Society<SUP class=reference id=cite_ref-Thorp_talk_1-0>[2]</SUP> and later in his books Beat the Dealer<SUP class=reference id=cite_ref-Beat_the_Dealer_2-0>[3]</SUP> (for gambling) and Beat the Market<SUP class=reference id=cite_ref-Beat_the_Market_3-0>[4]</SUP> (with Sheen Kassouf, for investing).

Although the Kelly strategy's promise of doing better than any other strategy seems compelling, some economists have argued strenuously against it, mainly because an individual's specific investing constraints override the desire for optimal growth rate.<SUP class=reference id=cite_ref-Poundstone_book_article_4-0>[5]</SUP> The conventional alternative is utility theory which says bets should be sized to maximize the expected utility of the outcome (to an individual with logarithmic utility, the Kelly bet maximizes utility, so there is no conflict). Even Kelly supporters usually argue for fractional Kelly (betting a fixed fraction of the amount recommended by Kelly) for a variety of practical reasons, such as wishing to reduce volatility, or protecting against non-deterministic errors in their advantage (edge) calculations.<SUP class=reference id=cite_ref-Wilmott_I_5-0>[6]</SUP>

In recent years, Kelly has become a part of mainstream investment theory<SUP class=reference id=cite_ref-Handbook_of_Asset_and_Liability_Management_6-0>[7]</SUP> and the claim has been made that well-known successful investors including Warren Buffett<SUP class=reference id=cite_ref-The_Dhandho_Investor_7-0>[8]</SUP> and Bill Gross<SUP class=reference id=cite_ref-Wilmott_II_8-0>[9]</SUP> use Kelly methods. William Poundstone wrote an extensive popular account of the history of Kelly betting in Fortune's Formula<SUP class=reference id=cite_ref-Poundstone_book_article_4-1>[5]</SUP>.

<TABLE class=toc id=toc summary=Contents><TBODY><TR><TD>Contents

[hide]

- <LI class=toclevel-1>1 Statement <LI class=toclevel-1>2 Proof <LI class=toclevel-1>3 Reasons to bet less than Kelly <LI class=toclevel-1>4 Bernoulli <LI class=toclevel-1>5 See also <LI class=toclevel-1>6 Cited references

- 7 External links

[edit] Statement

For simple bets with two outcomes, one involving losing the entire amount bet, and the other involving winning the bet amount multiplied by the payoff odds, the Kelly bet is:

<DL><DD>

</DD></DL>where

</DD></DL>where- f* is the fraction of the current bankroll to wager;

- b is the net odds received on the wager (that is, odds are usually quoted as "b to 1")

- p is the probability of winning;

- q is the probability of losing, which is 1 − p.

If the gambler has zero edge, i.e. if b = q/p, then the criterion will usually recommend the gambler bets nothing (although in more complex scenarios, where for instance a short priced favourite in a horse race may be worth covering to provide downside protection even though the only advantageous bet is on another outsider, will be correctly bet on to ensure the best compounding rate of return). If the edge is negative (b < q/p) the formula gives a negative result, indicating that the gambler should take the other side of the bet. For example, in standard American roulette, the bettor is offered an even money payoff (b = 1) on red, when there are 18 red numbers and 20 non-red numbers on the wheel (p = 18/38). The Kelly bet is -1/19, meaning the gambler should bet one-nineteenth of the bankroll that red will not come up. Unfortunately, the casino reserves this bet for itself, so a Kelly gambler will not bet.

For even-money bets (i.e. when b = 1), the formula can be simplified to:

<DL><DD>

</DD></DL>Since q = 1-p, this simplifies further to

</DD></DL>Since q = 1-p, this simplifies further to<DL><DD>

</DD></DL>

</DD></DL>[edit] Proof

For a rigorous and general proof, see Kelly's original paper<SUP class=reference id=cite_ref-original_Kelly_article_0-1>[1]</SUP> or some of the other references listed below. Some corrections can be found in: Optimal Gambling Systems For Favourable Games:- L. Breiman, University of California, Los Angeles.

We give the following non-rigorous argument for the case b = 1 to show the general idea and provide some insights.

When b = 1, the Kelly bettor bets 2p - 1 times initial wealth, W, as shown above. If she wins, she has 2pW. If she loses, she has 2(1 - p)W. Suppose she makes N bets like this, and wins K of them. The order of the wins and losses doesn't matter, she will have:

<DL><DD>

</DD></DL>Suppose another bettor bets a different amount, (2p - 1 + Δ)W for some positive or negative Δ. He will have (2p + Δ)W after a win and [2(1 - p)- Δ]W after a loss. After the same wins and losses as the Kelly bettor, he will have:

</DD></DL>Suppose another bettor bets a different amount, (2p - 1 + Δ)W for some positive or negative Δ. He will have (2p + Δ)W after a win and [2(1 - p)- Δ]W after a loss. After the same wins and losses as the Kelly bettor, he will have:<DL><DD>

</DD></DL>Take the derivative of this with respect to Δ and get:

</DD></DL>Take the derivative of this with respect to Δ and get:<DL><DD>

</DD></DL>which equals zero if:

</DD></DL>which equals zero if:<DL><DD>

</DD></DL>which implies:

</DD></DL>which implies:<DL><DD>

</DD></DL>but:

</DD></DL>but:<DL><DD>

</DD></DL>so in the long run, final wealth is maximized by setting Δ to zero, which means following Kelly strategy.

</DD></DL>so in the long run, final wealth is maximized by setting Δ to zero, which means following Kelly strategy.This illustrates that Kelly has both a deterministic and a stochastic component. If you knew K and N and had to pick a constant fraction of wealth to bet each time (otherwise you could cheat and, for example, bet zero after the K<SUP>th</SUP> win knowing that the rest of the bets will lose), you will end up with the most money if you bet:

<DL><DD>

</DD></DL>each time. This is true whether N is small or large. The "long run" part of Kelly is necessary because you don't know K in advance, just that as N gets large, K will approach pN. Someone who bets more than Kelly can do better if K > pN for a stretch, someone who bets less than Kelly can do better if K < pN for a stretch, but in the long run, Kelly always wins.

</DD></DL>each time. This is true whether N is small or large. The "long run" part of Kelly is necessary because you don't know K in advance, just that as N gets large, K will approach pN. Someone who bets more than Kelly can do better if K > pN for a stretch, someone who bets less than Kelly can do better if K < pN for a stretch, but in the long run, Kelly always wins.[edit] Reasons to bet less than Kelly

A natural assumption is that taking more risk increases the probability of both very good and very bad outcomes. One of the most important ideas in Kelly is that betting more than the Kelly amount decreases the probability of very good results, while still increasing the probability of very bad results. Since in reality we seldom know the precise probabilities and payoffs, and since overbetting is worse than underbetting, it makes sense to err on the side of caution and bet less than the Kelly amount.

Kelly assumes sequential bets that are independent (later work generalizes to bets that have sufficient independence). That may be a good model for some gambling games, but generally does not apply in investing and other forms of risk-taking. Suppose an investor is offered 10 different bets with 40% chance of winning and 2 to 1 payoffs (this is the example used above). Considering the bets one at a time, Kelly says to bet 10% of wealth on each, which means the investor's entire wealth is at risk. That risks ruin, especially if the payoffs of the bets are correlated.

The Kelly property appears "in the long run" (that is, it is an asymptotic property). To a person, it matters whether the property emerges over a small number or a large number of bets. It makes sense to consider not just the long run, but where losing a bet might leave you in the short and medium term as well. A related point is that Kelly assumes the only important thing is long-term wealth. Most people also care about about the path to get there. Two people dying with the same amount of money need not have had equally happy lives. Kelly betting leads to highly volatile short-term outcomes which many people find unpleasant, even if they believe they will do well in the end.

One of the most unrealistic assumptions in the Kelly derivation is that wealth is both the goal and the limit to what you can bet. Most people cannot bet their entire wealth, for example it is illegal to bet your future human capital (you cannot sell yourself into slavery). On the other hand, people can bet money they do not have by borrowing. A person who is allowed to bet more than his wealth might choose to bet more than Kelly (if you know you can always borrow a new stake, it makes sense to take more risk) while someone who is constrained to bet much less than his wealth (say a young college graduate with high lifetime potential earnings but no cash or credit) is forced to bet less.

[edit] Bernoulli

In a 1738 article, Daniel Bernoulli suggested that when you have a choice of bets or investments you should choose that with the highest geometric mean of outcomes. This is mathematically equivalent to the Kelly criterion, although the motivation is entirely different (Bernoulli wanted to resolve the St. Petersburg paradox). The Bernoulli article was not translated into English<SUP class=reference id=cite_ref-Bernoulli_translation_9-0>[10]</SUP> until 1956 but the work was well-known among mathematicians and economists.

cassiusclay

EOG Master

Re: Warren Buffet and.....

knowledge is power

knowledge is power

cassiusclay

EOG Master

Re: Warren Buffet and.....

6. Gambling Is A Fools Game

“Rule No.1: Never lose money. Rule No.2: Never forget rule No.1.” - Warren Buffett

While we are young and naive we choose to take risks with our money that are dumb and stupid. Trying to hit a home run with your money every time is a losing proposition with long term consequences. To chase investments that offer a high rate of return you must also assume that it also comes with a higher rate of risk. Bill Gates once quipped “Warren’s and my betting has always been confined to $1 bets” when talking about them paying poker together. If two billionaires take risk management this seriously, it’s time we average punters did the same thing.

6. Gambling Is A Fools Game

“Rule No.1: Never lose money. Rule No.2: Never forget rule No.1.” - Warren Buffett

While we are young and naive we choose to take risks with our money that are dumb and stupid. Trying to hit a home run with your money every time is a losing proposition with long term consequences. To chase investments that offer a high rate of return you must also assume that it also comes with a higher rate of risk. Bill Gates once quipped “Warren’s and my betting has always been confined to $1 bets” when talking about them paying poker together. If two billionaires take risk management this seriously, it’s time we average punters did the same thing.

cassiusclay

EOG Master

Re: Warren Buffet and.....

8 Money Secrets From Warren Buffett

Written on August 28, 2007 by Tezza

Tuesday’s weekly guide to Personal Finance from 4EvaYoung.com

We all have someone whom we admire and respect. For me one person on my shortlist is Warren Buffett who is sometimes referred to as the “Sage of Omaha“. I first heard about Buffett back in 2001 when I first started getting serious about investing and so I started reading all the titles with his name on it. Off course Buffett hasn’t actually written any of them but they were priceless none the less.

If you have never heard of Buffett, Forbes currently ranks him as the third richest man in the world and he is arguably the world’s greatest investor. He has amassed his fortune by making astute investment decisions and investing in businesses. Here is what I have learnt from Buffett:

1. Rich Is A State Of Mind

“I always knew I was going to be rich. I don’t think I ever doubted it for a minute.” - Warren Buffett

The difference between being poor and being rich is really just a state of mind. Poor people think thoughts of poverty and lack, rich people think thoughts of abundance and prosperity. Your beliefs are going to determine the way you perceive wealth, the decisions you make and the way you act towards it.

2. Success Is More Than About Your Bank Balance

When asked by CNBC what is the secret to success, Buffett replied “If people get to my age and they have the people love them that they want to have love them, they’re successful. It doesn’t make any difference if they’ve got a thousand dollars in the bank or a billion dollars in the bank… Success is really doing what you love and doing it well. It’s as simple as that. I’ve never met anyone doing that who doesn’t feel like a success. And I’ve met plenty of people who have not achieved that and whose lives are miserable.”

3. Spend Less Than You Earn

“Should you find yourself in a chronically leaking boat, energy devoted to changing vessels is likely to be more productive than energy devoted to patching leaks.” -Warren Buffett

It seems like common sense advice and you’ve no doubt heard financial experts preaching about it for years. You can’t possibly get ahead financially if you’re spending more than your paycheck. Buffett is famous for living a simple and frugal lifestyle. He is the only billionaire I know that still lives in the same house he bought back in 1958 for $31,500. He drove a 2001 Lincoln Town Car for years which he bought second hand. Buffett has a net worth in excess of $52 billion and yet lives off an annual salary of $100,000. The relative percentage of his spending based on his overall net worth is minuscule.

4. Avoid Consumer Debt

The sooner we realize that consumerism is a social plague that has been propagated by billion dollar marketing machines to keep you shackled to your job, the sooner we can stop spending money on useless stuff. It is a fool’s game to spend today so that you can work tomorrow to pay it off. It is a losing proposition because one day your working days are going to be over but the debt is still going to be hanging over your head. Clever marketing has convinced our society that to be happy you have to have more, be more and do more. Buffett abhors consumer debt instead choosing to use debt wisely by leveraging it in investments. To help you deal with your debt consider reading “How To Get Yourself Out Of Debt“.

5. You Are Who You Associate With

“It’s better to hang out with people better than you. Pick out associates whose behavior is better than yours and you’ll drift in that direction.” -Warren Buffett

If you want to succeed financially you need to associate with people who are most conducive to encouraging and cheering on your financial journey. If the people you associate with see money as evil, object to capitalism and find wealth a foreign concept then your financial health and well being is going to be influenced by their views. Whether we like it or not we are all influenced to some extent by the people we spend our primary time with. If you aspire to achieve financial security then you need to find a mastermind of people in your life whom you can all encourage and help each other.

6. Gambling Is A Fools Game

“Rule No.1: Never lose money. Rule No.2: Never forget rule No.1.” - Warren Buffett

While we are young and naive we choose to take risks with our money that are dumb and stupid. Trying to hit a home run with your money every time is a losing proposition with long term consequences. To chase investments that offer a high rate of return you must also assume that it also comes with a higher rate of risk. Bill Gates once quipped “Warren’s and my betting has always been confined to $1 bets” when talking about them paying poker together. If two billionaires take risk management this seriously, it’s time we average punters did the same thing.

7. Give Back To The Community

“Of the billionaires I have known, money just brings out the basic traits in them. If they were jerks before they had money, they are simply jerks with a billion dollars.” - Warren Buffett

They say that to have more you need to give more. A contradiction in terms, maybe, but it’s a simple truth that is as enduring as time. As the bible says “It is more blessed to give than to receive -Acts 20:35”. Buffett has announced in 2006 that he was giving away over $30 billion to the Bill and Melinda Gates Foundation making it at the time of writing the largest charitable donation in history. He also contributes large sums to his children’s charitable foundations.

8. Generosity and Abundance Goes Hand In Hand

“Even though Ben Graham [Buffett's mentor] had everything he needed in life, he still wanted to give something back by teaching, So just as we got it from somebody else, we don’t want it to stop with us. We want to pass it along too.” - Warren Buffett

A famous bible quote goes:“What benefit will it be to you if you gain the whole world but lose your own soul?” - Mark 8:36. The path to wealth isn’t a solo endeavor. How sad would life be if you come to the end of your life and there is no one to share it with. So as you journey on your path to financial abundance remember that there will be many people who generously helped you on your journey so it is only fitting to pay it forward when the opportunity arises. Generosity with your time, with your money, with your resources are great virtues to have. The greatest ally to building a strong friendship is to help others achieve what they want from life.

I leave you with this last quote “You only have to do a very few things right in your life so long as you don’t do too many things wrong.” - Warren Buffett

8 Money Secrets From Warren Buffett

Written on August 28, 2007 by Tezza

Tuesday’s weekly guide to Personal Finance from 4EvaYoung.com

We all have someone whom we admire and respect. For me one person on my shortlist is Warren Buffett who is sometimes referred to as the “Sage of Omaha“. I first heard about Buffett back in 2001 when I first started getting serious about investing and so I started reading all the titles with his name on it. Off course Buffett hasn’t actually written any of them but they were priceless none the less.

If you have never heard of Buffett, Forbes currently ranks him as the third richest man in the world and he is arguably the world’s greatest investor. He has amassed his fortune by making astute investment decisions and investing in businesses. Here is what I have learnt from Buffett:

1. Rich Is A State Of Mind

“I always knew I was going to be rich. I don’t think I ever doubted it for a minute.” - Warren Buffett

The difference between being poor and being rich is really just a state of mind. Poor people think thoughts of poverty and lack, rich people think thoughts of abundance and prosperity. Your beliefs are going to determine the way you perceive wealth, the decisions you make and the way you act towards it.

2. Success Is More Than About Your Bank Balance

When asked by CNBC what is the secret to success, Buffett replied “If people get to my age and they have the people love them that they want to have love them, they’re successful. It doesn’t make any difference if they’ve got a thousand dollars in the bank or a billion dollars in the bank… Success is really doing what you love and doing it well. It’s as simple as that. I’ve never met anyone doing that who doesn’t feel like a success. And I’ve met plenty of people who have not achieved that and whose lives are miserable.”

3. Spend Less Than You Earn

“Should you find yourself in a chronically leaking boat, energy devoted to changing vessels is likely to be more productive than energy devoted to patching leaks.” -Warren Buffett

It seems like common sense advice and you’ve no doubt heard financial experts preaching about it for years. You can’t possibly get ahead financially if you’re spending more than your paycheck. Buffett is famous for living a simple and frugal lifestyle. He is the only billionaire I know that still lives in the same house he bought back in 1958 for $31,500. He drove a 2001 Lincoln Town Car for years which he bought second hand. Buffett has a net worth in excess of $52 billion and yet lives off an annual salary of $100,000. The relative percentage of his spending based on his overall net worth is minuscule.

4. Avoid Consumer Debt

The sooner we realize that consumerism is a social plague that has been propagated by billion dollar marketing machines to keep you shackled to your job, the sooner we can stop spending money on useless stuff. It is a fool’s game to spend today so that you can work tomorrow to pay it off. It is a losing proposition because one day your working days are going to be over but the debt is still going to be hanging over your head. Clever marketing has convinced our society that to be happy you have to have more, be more and do more. Buffett abhors consumer debt instead choosing to use debt wisely by leveraging it in investments. To help you deal with your debt consider reading “How To Get Yourself Out Of Debt“.

5. You Are Who You Associate With

“It’s better to hang out with people better than you. Pick out associates whose behavior is better than yours and you’ll drift in that direction.” -Warren Buffett

If you want to succeed financially you need to associate with people who are most conducive to encouraging and cheering on your financial journey. If the people you associate with see money as evil, object to capitalism and find wealth a foreign concept then your financial health and well being is going to be influenced by their views. Whether we like it or not we are all influenced to some extent by the people we spend our primary time with. If you aspire to achieve financial security then you need to find a mastermind of people in your life whom you can all encourage and help each other.

6. Gambling Is A Fools Game

“Rule No.1: Never lose money. Rule No.2: Never forget rule No.1.” - Warren Buffett

While we are young and naive we choose to take risks with our money that are dumb and stupid. Trying to hit a home run with your money every time is a losing proposition with long term consequences. To chase investments that offer a high rate of return you must also assume that it also comes with a higher rate of risk. Bill Gates once quipped “Warren’s and my betting has always been confined to $1 bets” when talking about them paying poker together. If two billionaires take risk management this seriously, it’s time we average punters did the same thing.

7. Give Back To The Community

“Of the billionaires I have known, money just brings out the basic traits in them. If they were jerks before they had money, they are simply jerks with a billion dollars.” - Warren Buffett

They say that to have more you need to give more. A contradiction in terms, maybe, but it’s a simple truth that is as enduring as time. As the bible says “It is more blessed to give than to receive -Acts 20:35”. Buffett has announced in 2006 that he was giving away over $30 billion to the Bill and Melinda Gates Foundation making it at the time of writing the largest charitable donation in history. He also contributes large sums to his children’s charitable foundations.

8. Generosity and Abundance Goes Hand In Hand

“Even though Ben Graham [Buffett's mentor] had everything he needed in life, he still wanted to give something back by teaching, So just as we got it from somebody else, we don’t want it to stop with us. We want to pass it along too.” - Warren Buffett

A famous bible quote goes:“What benefit will it be to you if you gain the whole world but lose your own soul?” - Mark 8:36. The path to wealth isn’t a solo endeavor. How sad would life be if you come to the end of your life and there is no one to share it with. So as you journey on your path to financial abundance remember that there will be many people who generously helped you on your journey so it is only fitting to pay it forward when the opportunity arises. Generosity with your time, with your money, with your resources are great virtues to have. The greatest ally to building a strong friendship is to help others achieve what they want from life.

I leave you with this last quote “You only have to do a very few things right in your life so long as you don’t do too many things wrong.” - Warren Buffett

cassiusclay

EOG Master

Re: Warren Buffet and.....

:LMAO:LMAO:LMAO

12io4j2w90

Yeah, but who does he like in the NBA playoffs?

:LMAO:LMAO:LMAO

12io4j2w90

cassiusclay

EOG Master

Re: Warren Buffet and.....

i thought the same, most "sharp" gamblers don't reveal why they are successful, Buffet would qualify as the "sharpest of sharp" gamblers...

Seriously, though, it is some interesting stuff. If that is what he uses, Buffett has certainly done well with it.

i thought the same, most "sharp" gamblers don't reveal why they are successful, Buffet would qualify as the "sharpest of sharp" gamblers...